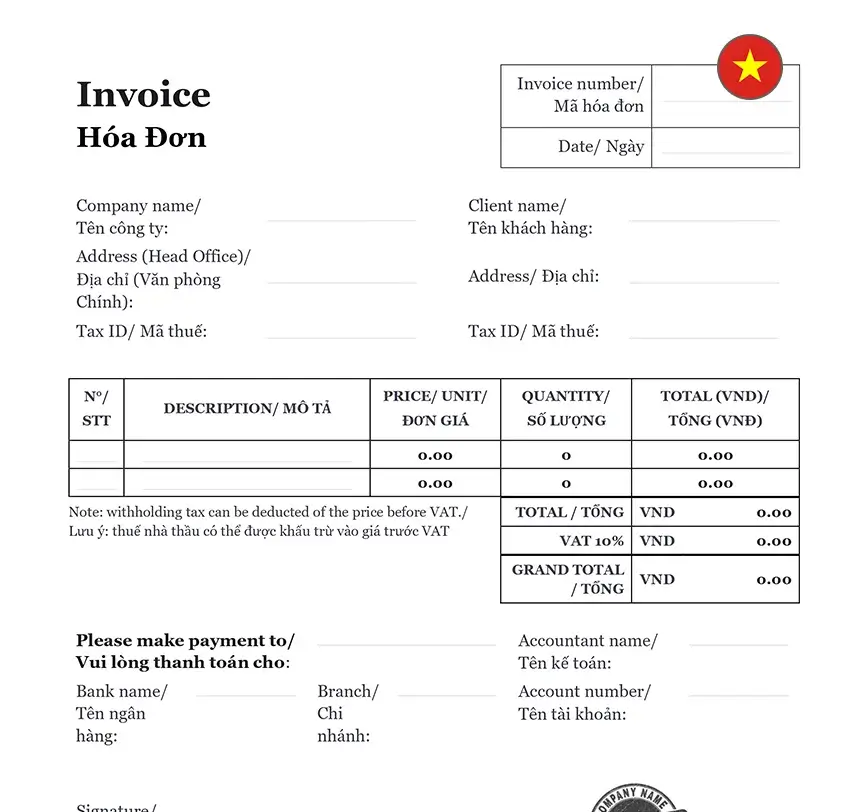

Understanding Vietnamese Billing Statements Requirements

In Vietnam, billing statements must comply with specific legal standards set by the General Department of Taxation (GDT). These standards ensure that billing statements are complete, accurate, and legally enforceable. According to the GDT, a billing statement must include critical details such as the date of issuance, the full contact information of both the buyer and the seller, and a detailed description of the goods or services provided. Ensuring that your billing statements meet these requirements is crucial for maintaining compliance and avoiding potential legal issues. For structured billing documentation, use our Invoice Template.

Key Components of Vietnamese Billing Statements

When preparing billing statements, several key components must be included to ensure compliance with Vietnamese law. Each element plays a vital role in documenting the transaction accurately:

1. Business Information: This includes the full name, address, and tax identification number of both the issuing business and the recipient. Providing complete and accurate business details helps establish the legitimacy of the transaction and facilitates smooth communication between parties. For clear billing terms, draft with our General Receipt Template.

2. Invoice Number: Each billing statement should have a unique invoice number. This numbering system should be sequential and non-repetitive to avoid confusion and ensure that each invoice can be tracked and referenced easily.

3. Date of Issue: The date on which the billing statement is issued must be clearly indicated. This helps establish the timeline for payment and ensures that the invoice is processed promptly.

4. Description of Goods/Services: A detailed description of the goods or services provided is essential. This should include any relevant specifications, quantities, and the nature of the services rendered. Clear descriptions help prevent disputes and ensure both parties understand the transaction’s terms.

5. Quantity and Price: The billing statement must specify the quantity and unit price of the goods or services. Accurate pricing information ensures that the amounts charged are transparent and agreed upon by both parties.

6. Total Amount: The total amount due, including any applicable taxes, should be clearly stated. This includes the subtotal before taxes and the final amount payable after taxes are applied.

7. Tax Information: If applicable, include VAT rates and amounts. In Vietnam, VAT is a significant component of billing statements, and correct application of VAT rates is crucial for compliance. To ensure accurate records, utilize our Accounting Services.

Creating Compliant Billing Statements

To create billing statements that comply with Vietnamese law, follow these guidelines:

1. Invoice Format and Layout

A well-organized billing statement enhances clarity and reduces the risk of errors. Here’s a sample layout for creating a compliant billing statement:

| ➤ Business Name: Enter the full legal name of your company. Ensure it matches the registration documents. |

| ➤ Business Address: Provide the complete address where your business is located. This helps in verifying the origin of the invoice. |

| ➤ Tax Identification Number: Include your business’s tax identification number, as issued by the Vietnamese tax authorities. This is crucial for tax reporting. |

| ➤ Invoice Number: Assign a unique, sequential invoice number to each billing statement to track and reference it easily. |

| ➤ Date of Issue: Specify the exact date when the invoice is issued. This date is essential for payment terms and auditing. |

| ➤ Customer Name: Record the name of the customer or client to whom the billing statement is addressed. This should match their official business name. |

| ➤ Customer Address: Include the complete address of the customer. This ensures that the billing statement reaches the correct recipient. |

| ➤ Description of Goods/Services: Provide a thorough description of the goods or services provided. Include any relevant details that clarify the nature of the transaction. |

| ➤ Quantity: State the quantity of goods or services provided. Accurate quantity information helps in verifying the order details. |

| ➤ Unit Price: List the unit price for each item or service. Ensure that the price is consistent with any agreements or contracts. |

| ➤ Total Amount: Calculate the total amount due, including taxes. This should be clearly distinguished from the subtotal. |

| ➤ VAT: If VAT is applicable, specify the VAT rate and the total VAT amount. Ensure that VAT calculations are accurate and comply with local regulations. |